A. There's two simple styles: prepaid tuition options and cost savings designs. And each state has its individual system. Every single is somewhat exclusive. States are permitted to supply both equally styles. A qualified schooling establishment can only present you with a pay as you go tuition type 529 prepare.

Pay as you go tuition plans could Restrict the colleges they may be used for. By contrast, income inside of a cost savings prepare can be employed at almost any eligible institution.

A. An qualified educational establishment is generally any college or university, College, vocational faculty, or other postsecondary academic establishment eligible to get involved in a scholar help plan administered via the U.

Anyone can use our college financial savings calculator to figure out exactly how much to avoid wasting every month. Login or turn into a member to generate a personalized discounts planLog In Expected and observe your progress.

Martha is Main Development Officer for Savingforcollege.com, where by she sales opportunities initiatives to deliver revolutionary solutions to buyers and experts in the school financial savings marketplace. Formerly, Martha experienced a successful job building marketing and advertising and client methods for Fortune five hundred and begin-up providers in money providers, electronic media, retail and purchaser goods.

Bear in mind, as with any expenditure account, There may be some hazard when buying a 529 approach. Though you could earn revenue dependant on your investments, you could potentially also reduce funds. Hold this in mind when you’re deciding upon your system and investments.

Numerous 529 plans give focus on-day money, which adjust their property because the decades go by, getting to be much more conservative because the beneficiary strategies university age.

Named for a section of The inner Income Code (IRC), 529 options are tax-deferred savings programs intended to assistance pay for college costs. In some states, competent withdrawals for these prices usually are not matter to federal or condition taxes.

These expenses are frequently considered qualified training charges for 529 program cash, which has a handful of exceptions.

Family members with Distinctive demands may also think about using a 529 Equipped account to save lots of for college together with other training charges.

You should Verify with all your property point out to find out if it acknowledges the expanded 529 Advantages afforded underneath federal tax law, like distributions for elementary and secondary schooling costs, apprenticeship packages, and student loan repayments. You may want to talk to having a tax Specialist before investing or generating distributions.

Take into account that investing consists of chance. get more info The value of one's investment will fluctuate as time passes, and it's possible you'll gain or lose money.

If guides and materials are necessary to take part in a category, the complete cost of All those textbooks and supplies is taken into account a professional expense. This could include things like system textbooks, lab supplies, basic safety gear, or the rest necessary for your personal coursework.

The payment we obtain from advertisers would not influence the tips or suggestions our editorial crew presents in our content or normally affect any in the editorial material on Forbes Advisor. Whilst we work flat out to supply accurate and current details that we predict you will see pertinent, Forbes Advisor isn't going to and can't assurance that any details provided is finish and helps make no representations or warranties in relationship thereto, nor for the precision or applicability thereof. Here is a listing of our associates who offer you products which We've got affiliate links for.

Ralph Macchio Then & Now!

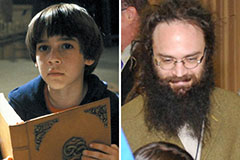

Ralph Macchio Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Traci Lords Then & Now!

Traci Lords Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!